Most business owners consider starting an LLC as the smart choice. Some prefer this corporate entity for its flexibility, some for its personal asset protection.

There is no doubt LLCs can minimize risk significantly, especially on the owner’s part.

Anyone can form an LLC with no restrictions on citizenship, the number of members, or business type. The only limitation that may come into play concerns licensed professionals.

You see, while an LLC doesn’t involve stringent formation rules, only licensed professionals by the state licensing board can form a PLLC. Read on as I tell you how adding a P before LLC changes incorporation rules in the business world.

What are LLC and PLLC Entities?

Despite the similar names, an LLC and a PLLC aren’t the same. Let’s review what both acronyms mean and how they work.

What’s an LLC?

A limited liability company (LLC) is a legal business structure that provides business owners with certain perks, namely, limited liability protection and a sole proprietorship and partnership’s pass-through taxation benefits.

LLC owners have the flexibility to shape the company, its profit structure, and its profit allocation according to their needs and goals. At the same time, they get personal asset protection if the business is ever sued—unlike a sole proprietorship or a partnership structure.

And that’s not it: LLCs are also simpler than corporations and don’t run the risk of double taxation. No other entity offers the kind of simplicity and flexibility provided by LLCs.

Basically, LLCs are versatile entities that try to combine the best bits of business structures.

What is a PLLC?

A professional limited liability company (PLLC) is formed by individuals who can provide specific professional services.

Licensed professionals—doctors, architects, accountants, and lawyers—can form businesses with the benefits of an LLC. But instead of sticking to the traditional structure, they have to form an alternative entity, i.e., a PLLC, which is specially designed for businesses requiring professional licensing to operate.

A PLLC isn’t as straightforward as LLCs, though. Forming a PLLC has certain requirements that vary by state, with a few states not even offering PLLC formation.

Additionally, you cannot start a PLLC without proof of licensing and member approval from the state licensing board. Some industries may have their own regulations as well.

The Basics of LLCs vs. PLLCs

LLCs and PLLCs have similarities. But they also have differences. Keep reading as we break them down in more detail.

Company Names

LLCs definitely have more flexibility in using names than PLLCs.

An LLC can use any name they want as long as it isn’t registered by other businesses and it meets state requirements. Operating under a trade name, also known as a fictitious name, is also allowed—provided the owners file a “Doing Business As” (DBA) form.

LLC owners must avoid using restricted words that may imply they are a government agency or affiliate and are required to have “limited liability company” or an abbreviation in the name.

On the other hand, a PLLC is forbidden to use a name other than its registered name—or its “true name.“ It may be required to include the names of their members, but this can vary based on state laws. Arizona, for instance, allows dentists to use trade names but doesn’t extend the same courtesy to lawyers and real estate brokers.

As a PLLC owner, you can choose to include or refer to non-licensed persons in your company‘s name if you want.

Formation and Membership

Under an LLC, any person or business can become a member or owner and act on its behalf. Contrarily, only licensed individuals who can provide the service can own interest in a PLLC.

While non-licensed employees can be a part of a PLLC, they must work under a licensed member’s, manager’s, and/or employee’s supervision or direction. This, in turn, retains the ultimate responsibility for the work with the professional.

Interestingly, all members or owners of the PLLC have to be of the same profession—they should only offer services within their specific discipline. Therefore, if a member is a lawyer, then all PLLC members should be lawyers, or if the member is a doctor, they should all be doctors. There cannot be a PLLC with two lawyers and one doctor or any other combination of professions.

Besides that, a licensed professional has to sign all PLLC filing papers and include either a license number or a certified copy of their professional license during the filing process. All the necessary documents must be submitted for approval to the state licensing board before filing with your state’s security of the state.

Since there’s an additional approval step involved, the process to form a PLLC is usually longer than forming a standard LLC.

To see our top picks for the best LLC formation services, take a look at our in-depth reviews and why we picked them.

Permitted Business Activities

Putting it simply, an LLC is free to engage in (most) legal business activities, but a PLLC‘s business is restricted to the service for which its members are licensed.

Some standard LLCs can’t conduct practices (services like legal, medical, etc.) that require a license. As for circumstances where an LLC can render professional services, the non-licensed managers or owners must not interfere with the licensed professionals in providing the professional services.

For example, if a lawyer works for a standard LLC, only they have the right and duty to give legal advice. Similarly, only licensed doctors should diagnose and treat patients—no one else.

Tax Guidelines

LLC and PLLC structures aren’t recognized by the Internal Revenue Service (IRS) for tax purposes.

To come under their purview, you‘ll have to file your business as either a corporation, partnership, or S Corporation for multi-member LLCs (MMLLC), or corporation or sole proprietorship for single-member LLC (SMLLC). The IRS has also made it necessary for LLC and PLLC owners to fill out Form 8832 for classification purposes.

Failing to submit the form may put you at risk of automatic classification, which may be wrong. For instance, if your business has two or more members and is supposed to be taxed as a corporation, the IRS may classify it as a partnership by default.

The tax authority automatically classifies SMLLC businesses as “disregarded entities.” This term refers to entities that are disregarded as separate from the owner, in addition to their sole proprietorship status.

PLLCs and LLCs are subject to the same taxation requirements when it comes to paying taxes.

Limited Liability Protection for Negligence

LLCs and PLLCs both offer limited liability protection or the “corporate veil.”

Because of this, all your personal assets will remain safe from the potentially catastrophic financial effects of a lawsuit. Even if the court rules against you, your company’s creditors cannot come after your private assets, like your house, car, savings, and other personal assets—they’ll be restricted to certain business assets.

At the same time, the law doesn’t like excusing parties for negligence.

PLLCs, in particular, don’t have permission to force clients and patients to give up their right to sue for malpractice. Licensed professionals are held to a higher standard of loyalty, care, and ethics than non-professionals.

This makes sense as the very reason why clients come to professionals is for their superior expertise, knowledge, and skills.

5 Tools to Improve LLC and PLLC Incorporation

You’ll find several online LLC formation services that make starting a business—LLC or PLLC—super easy and convenient. Read on as we discuss our top five picks.

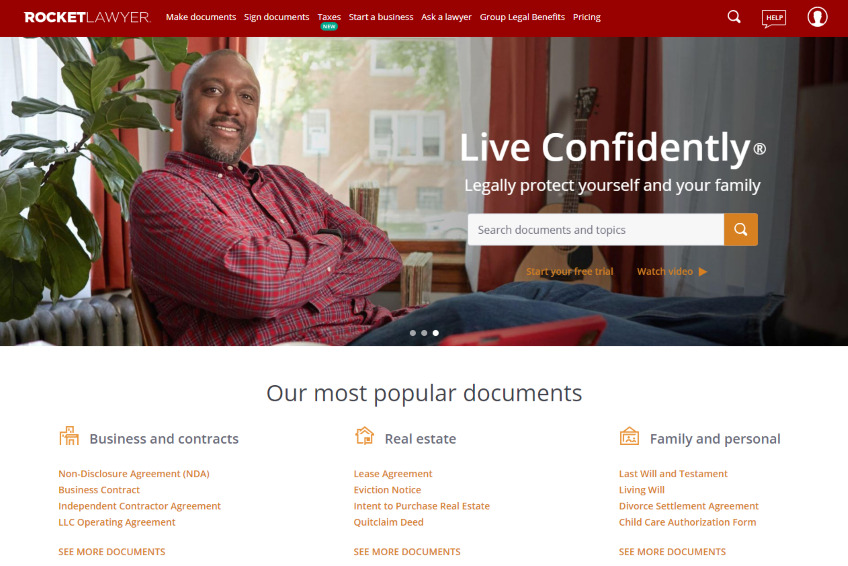

Rocket Lawyer

Rocket Lawyer offers some serious brand power where LLCs and PLLCs are concerned. It has a profound second-to-none experience where the company handles large volumes of business incorporation services.

This LLC service believes that everyone deserves access to simple and affordable legal services and does its best to offer all the assistance you need, anytime and anywhere. Business incorporation and legal documents become easy with Rocket Lawyer.

You also get access to several discounted services in addition to business formation, such as contracts, trademarks and patents, and legal consultations.

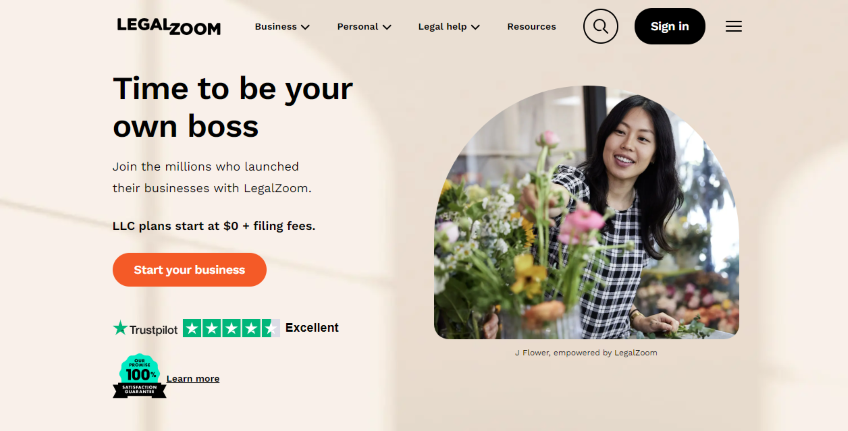

LegalZoom

LegalZoom caters to your business’s legal needs individually and goes deep in its offerings, ranging from business formation to attorney consultations to trusts and wills.

You also get a 100% satisfaction guarantee. LegalZoom offers a generous 60-day trial period, after which you can decide whether you want to continue with their services or not.

Moreover, instead of opting for a subscription plan, you pay for every service you need.

For instance, LLC formation services start at $0, plus filing fees, and trademark registration starts at $599, plus federal filing fees. Keeping up with the pricing is admittedly tricky, and you may have to talk to customer support for guidance.

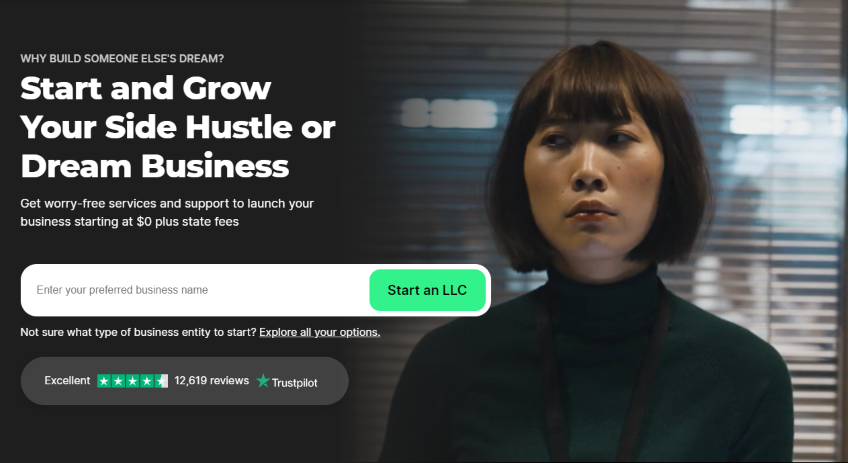

ZenBusiness

ZenBusiness boasts of a solid and long track record with millions of happy customers in all 50 states.

This LLC service leverages technology and automation to simplify LLC incorporation and filing. In addition, it offers several à la carte services, such as annual reports, Amendment, Business Insurance, Certificate of Good Standing, and so on.

It offers a professional and reliable registered agent who has the expertise and experience to get your business off the ground. ZenBusiness‘s past customers are extremely happy with its services, with many considering it to be the best LLC service available.

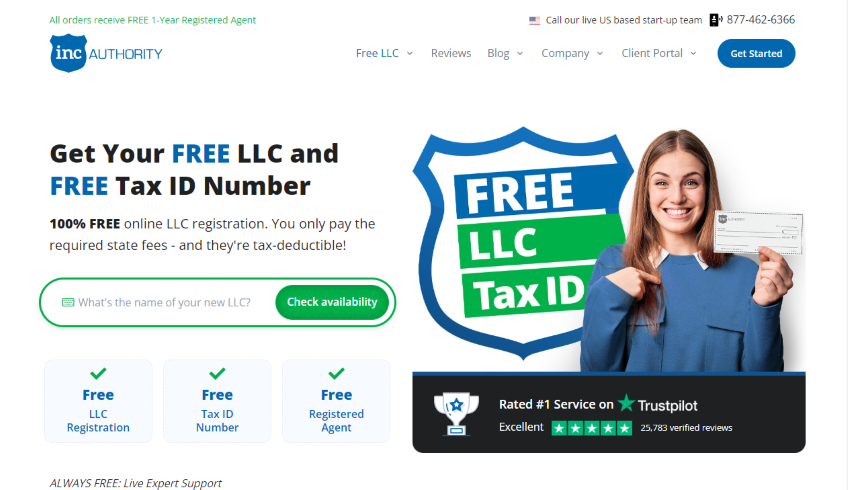

Inc Authority

To call Inc Authority affordable is an understatement.

This service lets you commence business operations at $0 (no kidding!) and handles a wide range of services, including drafting and filing limited liability companies and corporations. Inc Authority aspires to earn the customer’s trust and establish long-term relationships with its free business processing and formation service.

The company will file all your business structure paperwork on your behalf and then give you a free year of registered agent service.

Swyft Filings

Reliable LLC formation services and highly responsive customer support make Swyft Filings well worth your buck.

Specializing in small- and medium-sized business formation, this company can help you form an LLC or PLLC in as few as 10 minutes. Swyft Filings offers online legal consultation and does all the hard work to make the formation process as seamless as possible.

While the initial setup process is slightly complex and time-consuming, you get access to an excellent user dashboard that lets you keep track of how your business is doing once registration is done.

Lifetime customer support and several useful perks—all of which are available at a very reasonable price—cemented Swyft Filings’s position on this list.

3 Tricks to Form Your LLC and PLLC Easily

Let’s review three tried-and-tested formulas that can seriously make your limited liability business life easy.

Choose Your Business Entity Carefully

Be very careful when deciding on the type of LLC you want to create. Not only will it determine the kind of paperwork you’ll need, but it also affects your tax structure.

For example, opting to be a single-member LLC will lead you to get taxed as a sole proprietor. You’ll have to use Schedule C to file taxes and part of your personal tax return. On the other hand, choosing to be an S-Corp allows you to choose whether you want to be taxed as an S-Corp or a C-Corp.

Keep Your Company Bank Account Separate

Try to set up a bank account in the company‘s name as soon as you’re done filing your agency formation documents.

This specific account should be used solely for company transactions, such as purchase agreements, buying everyday office supplies, and so on. Likewise, payments to the company should always be made to the company account and not your personal account.

Be sure to never use company funds for your personal details or purchases. Otherwise, goats may end up removing your limited liability’s liability protection.

Keep Your LLC or PLLC Active

Forming an LLC or PLLC is just the beginning. Next, you need to make sure your business license stays active.

For this, we recommend referring to your state‘s Security of State website to find relevant and current information on how to do so. Generally, you’ll have to update any information pertaining to your LLC as well as pay an annual filing fee.

What to Do Next

We hope this guide will help you make the right decision between LLC vs. PLLC.

After making a choice, you need to use LLC services to start your business formation proceedings. As mentioned before, these services take care of everything—incorporation to legal advice to trademark filing. Just make sure you choose a reliable company.

Below are a few more QuickSprout articles that can help you fast-track your business to the path of success.